How Much Should Bhutan Worry About its Public Debt?

Financing for Development

Investment is key for high and sustainable growth. The Commission on Growth and Development1 concluded that high levels of investment (25 percent of GDP and above) are needed for strong and sustained growth.2 Investment requires financing from domestic and foreign savings. In Bhutan, investment as a share of Gross Domestic Product (GDP), at 48 percent in 2017, is one of the highest in the world.

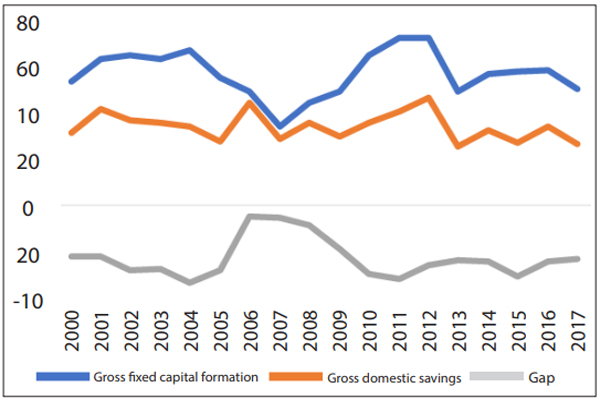

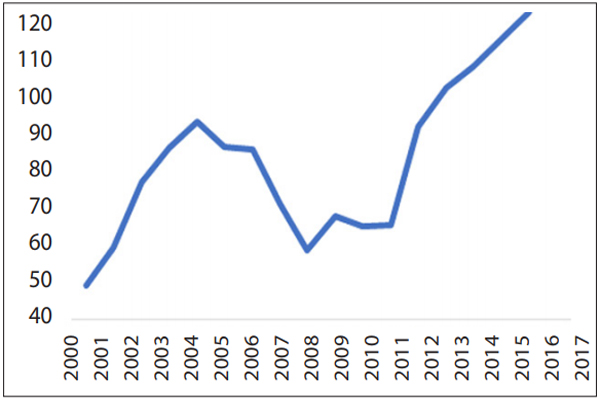

The high investment rate has been driven mainly by investment in hydropower. However, the country faces two challenges. First, its gross domestic savings (25 percent of GDP) do not fully finance the high levels of investment, resulting in a large investment-savings gap (ie, a current account deficit of 21 percent of GDP) (figure 1). Borrowing to finance the current account deficit has led to a rapid build-up of external debt, which exceeds 100 percent of GDP (figure 2). Second, investment beyond hydropower (example, infrastructure) is limited. Limited investment in infrastructure has led to a low quality of infrastructure.

For example, Bhutan ranks unfavourably in the logistics performance index (LPI), which measures performance on trade logistics.2 Bhutan ranks 149 among 160 countries in the 2018 data, lower than India (44), Bangladesh (100), and Nepal (114). Among sub-components of the LPI, Bhutan’s score on infrastructure is also low (150 among 160 countries).

Given significant demand on investment in physical capital (eg roads and ICT infrastructure) as well as human capital (eg health and education), financing for development is a key determinant for Bhutan’s medium

Figure 1. Large investment-saving gap has required financing needs (% GDP)

Source. World Development Indicators

Figure 2. As a result, the external debt to debt ratio kept increasing (% GDP)

Source. World Development Indicators

and long-term development. The postponement of the completion of two mega hydropower projects till 2022/23, towards the end of the 12th Five-Year Plan (FYP), suggests that hydropower will not be able to be a major financing source for development in the medium term. Although Bhutan will have additional financial resources after their completion, the hydropower bonanza will not last too long. Hydropower revenues are not expected to increase significantly thereafter, resulting in a declining share of hydropower revenues to GDP in the long-term. Thus, identifying financial sources other than hydropower for the budget and the economy is increasingly critical.

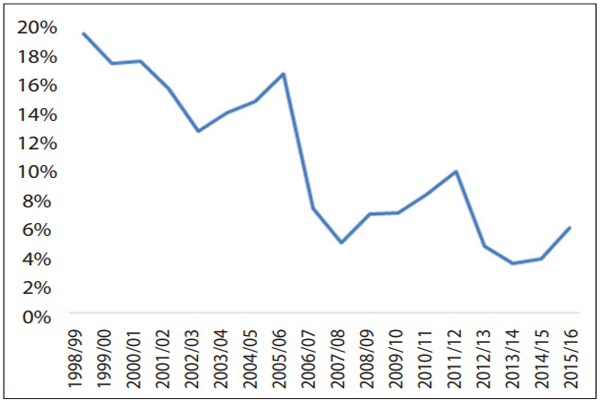

Traditionally, Bhutan has been conservative in debt financing, especially outside of hydropower. Given the stage of Bhutan’s development and comparatively high per capita income (currently at around USD 3,100 as of 2017), grant financing (as a share of GDP) is likely to decline further (figure 3). At the same time, due to an absence of major tax reforms and increase in tax exemptions, the tax to GDP ratio has declined from 14.7 percent in 2012 to 13.2 percent in 2016.

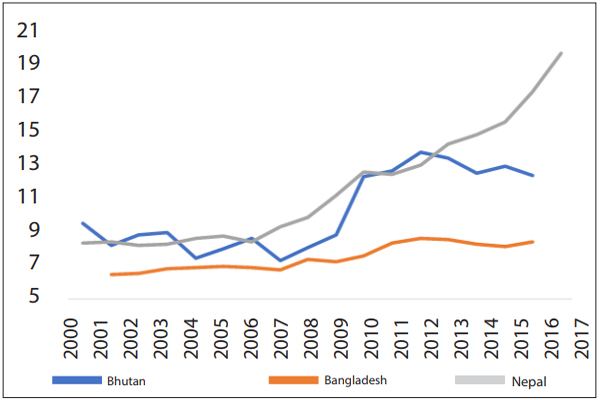

The comparison with Nepal shows that Bhutan lags behind in tax collections. (Figure 4)

Fig. 3. Declining budgetary grants (% GDP)

Source. World Development Indicators

Fig. 4. And declining tax revenues (% GDP)

Source. World Development Indicators

Financing the current account deficit is equally challenging. Bhutan has been promoting non-debt financing including remittances and Foreign Direct Investment (FDI). For example, the Royal Monetary Authority, the central bank, initiated Remit Bhutan in 2016. Also, several initiatives such as Brand Bhutan are expected to contribute to FDI. Despite the initiatives, FDI inflows have been limited; remittances accounted for 1.7 percent of GDP and net FDI inflows accounted for -0.4 percent of GDP in 2016. These figures are lower than the regional average.

Bhutan is moving in the right direction to mobilise non-debt financing. In the meantime, more efficient use and effective management of debt financing is likely to have a more immediate and direct impact on Bhutan’s financing needs for development. For example, concessional financing from multilateral organisations has potential. However, in Bhutan, there are heated debates on an accumulation of public debt. The debate seems legitimate. The external debt to GDP ratio doubled from 48 percent in 2000 to 114 percent in 2016 (figure 2). One concern is that the accumulation of public debt may lead to a debt crisis. A key question is how much Bhutan should worry about its current level of public debt?

Better Understanding of Debt

A widely-accepted conceptual definition of the external debt crises is the inability of debtors to make timely payments of interest and the repayment of principal. However, operationally, it is difficult to define “inability”. Thus, there are two approaches. One is actual defaulting or near default events. The other is the use of debt indicators.

In contrast to a debt crisis, debt sustainability refers to the ability to pay its debt obligation in the long- term without a liquidity problem. A debt to GDP ratio is a useful indicator to measure the size of debt relative to a country’s economy. Simple debt dynamics state that if the real interest rate of debt (ie, cost of debt) is lower than real GDP growth (ie, return on debt), the debt to GDP ratio tends to decline and is thus sustainable.

To measure a country’s risk of debt distress, the World Bank and the International Monetary Fund (IMF) developed the Debt Sustainability Framework (DSF) in 2005. A key part of the framework is the Debt Sustainability Analysis (DSA). The DSA is a structured examination of a country’s debt to assess the risk of external debt and the total public debt distress in that time, based on indicative debt burden thresholds that depend on the quality of the country’s policies and institutions.

A DSA assesses solvency and liquidity by comparing, for example, debt services (ie, the sum of principal and interest payments) and debt stock with various measure of a country’s repayment capacity, such as GDP, exports and revenues. To assess debt sustainability, these indicators are compared to indicative debt-burden thresholds and place the country into four categories of risk of debt distress-low, moderate, high, and in debt distress.

While the debt burden indicators are useful to signal a country’s risk of debt distress, the DSF suggests using judgement in case of the following events:

- Short-lived and marginal breaches

- Availability of liquid financial assets

- Long-term considerations and

- Availability of insurance type arrangements.

The final risk ratings are the results of the combination of the signals from the debt indicators and judgments.

Level and Structure of Bhutan’s Public Debt

Before applying the DSA to Bhutan, understanding Bhutan’s debt figures is critical. As of December 2017,the total public external debt was Nu 181 billion(B), equivalent to 99 percent of GDP.The public debt consists of domestic debt (Nu 12 billion, 7 percent of GDP) and external debt (Nu 169 billion 92 percent of GDP). The external debt is further disaggregated by borrowers and purposes (table 1). Hydropower accounts for about 75 percent of the external debt (69 percent of GDP), while non-hydropower accounts for 25 percent (24 percent of GDP).

| Purpose Borrowers | Hydropower | Non-Hydropower | Total |

|---|---|---|---|

| Government | 0 (0%) | 22 (13%) | 24 (13%) |

| State Enterprise | 126 (69%) | 6 (3%) | 132 (72%) |

| RMA | 0 (0%) | 13 (7%) | 13 (7%) |

| Total | 126 (69%) | 43 (24%) | 169 (92%) |

Table 1. Public External Debit Disaggregation (Nu Billion, % of GDP)

The disaggregation is important as each category has different characteristics. Non-hydropower government debt is borrowing from multilateral and bilateral agencies for socio-economic development including World Bank financing. This financing is highly concessional. For example, the latest World Bank financing term is a 0 percent interest rate with a 40-year repayment period. Non-hydropower debt by the Royal Monetary Authority (RMA) is small and includes Standby Credit Facility from the Government of India and SWAP arrangement from Reserve Bank of India. The largest external debt category is hydropower debt by state enterprises (including on lending from the government).

Hydropower debt, mainly from India, is for major hydropower projects including Tala, Punatsangchhu-I, Punatsangchhu-II, Mangdechhu, Dagachhu, Basochhu and Nikachhu. The financing terms for hydropower loans are aligned with construction periods (10 -15 years) with interest rates at around 10 percent. These projects are implemented under an inter-governmental agreement that the Government of India covers both financial and construction risks of the projects. When hydropower projects become operational, India buys surplus electricity at a price reflecting cost plus 15 percent net return. This mechanism naturally hedges exchange rate risks. Rupee denominated debt accounts for 76 percent of the total public external debt. The debt is mostly related to hydropower debt and revenues from hydropower exports to India are denominated by the Indian rupee.

Policy Framework to Manage Bhutan’s Public Debt

In addition to the level and structure of public debt, debt management is essential for debt sustainability. Thus debt policy/debt management is one of 16 indicators of the World Bank’s Country Policy and Institutional Assessment (CPIA). Among 74 low/lower-middle income IDA countries, Bhutan’s score is 8th highest in this indicator. The 2016 Public Expenditure and Financial Accountability (PEFA) assessment by the World Bank also shows that debt management is reasonably good, although there is room to improve, such as greater transparency of debt information. The adoption of the Public Debt Policy 2016 is an important achievement. The policy defines the legal framework, institutional arrangement, establishes a mechanism for risk assessment and monitoring, and sets a debt threshold.

Reflecting the unique debt situation, the 2016 Debt Policy disaggregates hydropower and non-hydropower debt. On the total external debt, annual debt service obligations should be lower than 25 percent of exports of goods and services. In addition, on non-hydropower debt, (a) debt stock should be lower than 35 percent of GDP, (b) government debt service should be lower than 22 percent of domestic revenues, (c) short-term external debt (by original maturity) should be lower than 30 percent of surplus reserves (ie, gross international reserves minus those that covers 12 months of essential imports), (d) sovereign guarantee should be lower than 5 percent of GDP. Actual figures are below all the non-hydro debt indicators. For example, as of end 2017, non-hydro debt stock was 24 percent of GDP.

Government debt services as a share of domestic revenues were 14 percent.

Applying the DSA to Bhutan

The World Bank-IMF joint DSA in 2016 confirms the DSAs in 2014. The DSA states that the risk of debt distress is assessed to remain moderate despite breaches in all five indicators under the baseline. All external debt indicators (eg, the external debt to GDP ratio) indicate that Bhutan is at a high risk of debt distress. For example, the present value of external debt to GDP ratio at about 150 percent is far above the threshold value at below 50 percent. Despite these indicators, the DSA concludes that Bhutan has a moderate risk of debt distress due to the country’s unique mitigating situation-large share of external debt is linked to hydropower project loans from India.

The dominance of hydro external debt means that debt sustainability is closely related to sustainability of hydro external debt. About 90 percent of hydro external debt is financed by India. The first interest and principal payments are expected in 2018. This timing is earlier than the scheduled commissions of the Punatsangchhu I and II. Also, construction costs are increasing, and delays and cost escalations raise concerns. However, the Government of India covers both the financial and construction risks of these projects and buys the surplus electricity output at a price reflecting cost plus a 15 percent net return . As long as the 15 percent net return is secured, even with delays affecting economic growth, government revenues and repayment capacity of non-hydro debt, Bhutan’s hydropower external debt is considered sustainable. Hydro external debt is therefore unlikely to lead to a debt crisis.

Non-hydro external debt is low at 24 percent of GDP. Also, the high proportion of concessional financing (low interest rate with long repayment period) and sustainable economic growth (exceeding 7 percent) in the past few decades suggest that non-hydropower external debt is also sustainable.

Risks and Areas for Improvement

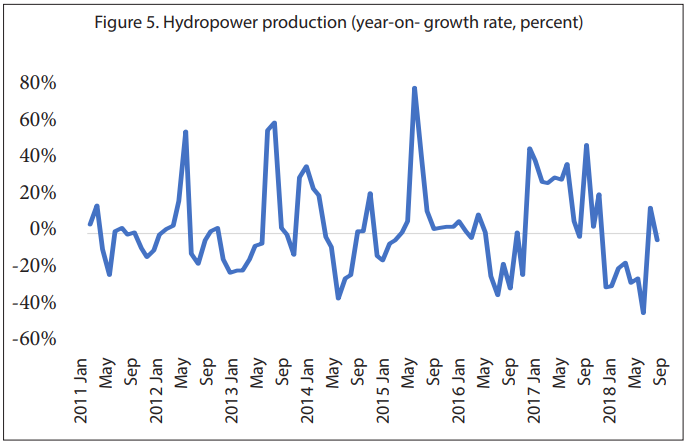

Although the assessment of the 2016 World Bank-IMF DSA, and the fact that Bhutan’s debt indicators are within the country’s thresholds, there are risks and areas for improvement. For example, operations of hydropower projects are affected by weather conditions and natural disasters. Actual hydropower production has significantly fluctuated in the past several years (figure 5).

In addition, better governance and institutional frameworks can be improved. The 2016 Debt Policy requires the establishment of a Public Debt Advisory Committee and formulates a Medium-Term Debt Management Strategy. However, these have not yet materialised.

Bhutan’s debt policy has traditionally focused on reducing risk of debt distress rather than leveraging debt for development purposes. Given the rapid accumulation of external debt since the 2000s, it is understandable, and the focus on reducing risks has contributed to macroeconomic stability. However, significant financing needs combined with the improved governance/institutional framework mean that the level of non-hydropower debt is lower than the threshold and the potential availability of concessional financing will enable Bhutan to start considering how best to use debt financing, especially concessional financing, for development. Bhutan’s GDP per capita (current USD) has exceeded USD 3,000, about three times as high as the threshold between low and lower-middle income countries of the World Bank. This implies that Bhutan’s access to concessional financing may not last long.

The government well recognises the importance of developing financing strategies. Bhutan’s Voluntary National Review Report on the Implementation of the 2030 Agenda for Sustainable Development3 puts developing financing strategies as one of operational priority actions:

Conclusion and Policy Recommendations

Given Bhutan’s financing needs for development and progress on non-debt financing, it is essential to explore how best Bhutan can use debt financing in its financing strategies. In doing so, balancing debt sustainability and leveraging debt financing will be critical through the following measures.

- Ensuring hydro external debt sustainability: The current arrangement-a 15 percent net return-ensures sustainability of hydro external debt. Maintaining this arrangement is critical.

- Effective implementation of debt-financed projects with maximising concessional financing: Debt sustainability of non-hydro external debt is subject to the viability of investments and cost of financing. On investments, debt must be used for productive purposes such as infrastructure and investing in health and education. On financing costs, maximising access to concessional financing (low interest rates) ensures sustainability.

- Maximising non-debt financing: Financing for development is not limited to debt financing. Maximising access to non-debt financing such as the equity part of FDI and remittances ensures stable financing for development and less reliance on debt financing.

- Implement the debt policy, especially the governance framework: The debt policy mandates the formulation of a Medium-Term Debt Management Strategy and regular debt sustainability analysis.

- Improve access to debt-related information: The 2016 public financial management performance report identified that access to information is a challenge. It is important to make the Medium-Term Debt Management Strategy, debt sustainability analysis, debt reports publicly available.

References

1. The Commission was an independent body that brought 22 policy makers, academics and business leadersto examine various aspects of economic growth and development.

2. http://siteresources.worldbank.org/EXTPREMNET/Resources/489960-1338997241035/Growth_Commission_Final_Report.pdf

3. https://sustainabledevelopment.un.org/content/documents/19369Bhutan_NSDGR_Bhutan_2018.pdf